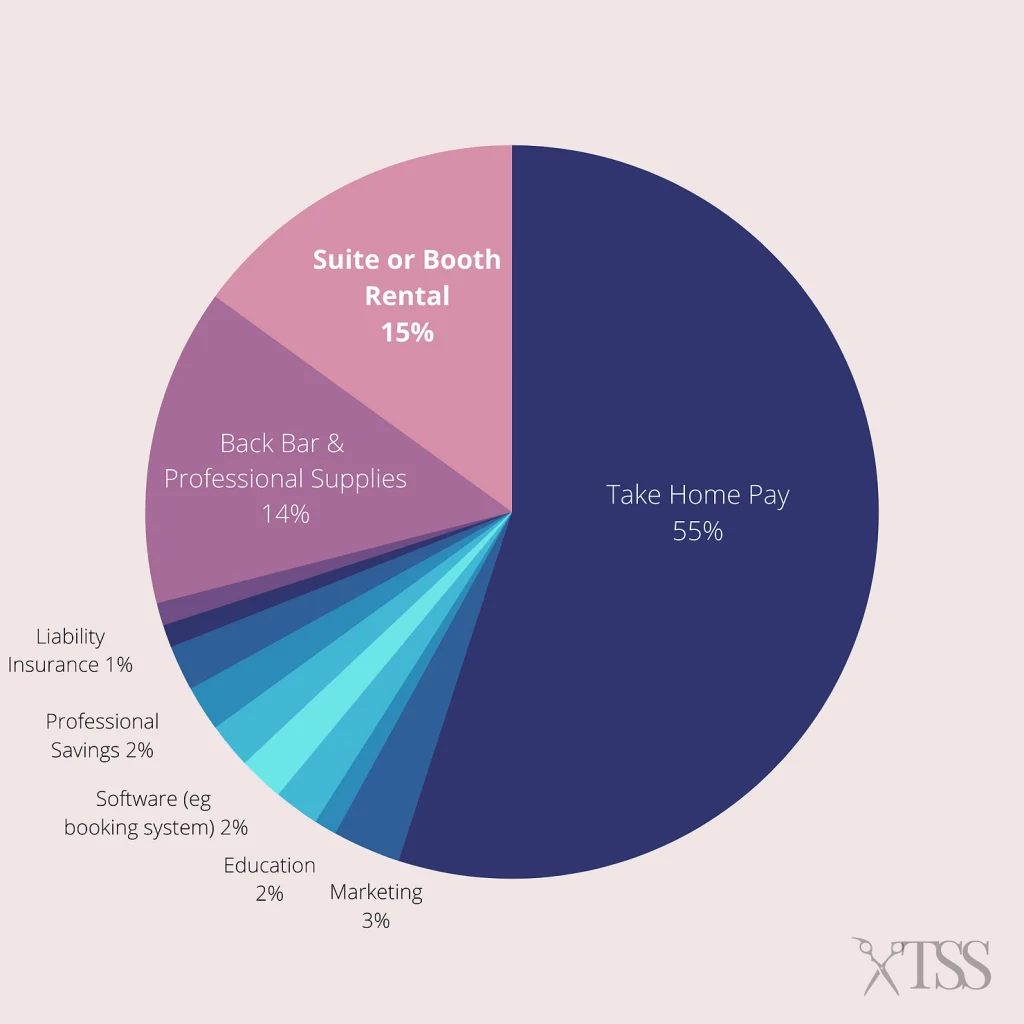

Having a solid budget is key to setting up and running a smooth and successful business. If you don’t know where to start, check out our breakdown on what you should be spending as an independent stylist!

• The first thing to know is how much you want your take home pay to be.

Our breakdown, as an example, uses a take home pay of 55% of your gross income.

• Your two biggest business expenses will be your chair or booth rental (15%), and your back bar and professional supplies.

As your biggest expenses, you want to make sure you are getting the biggest bang for your buck here. Consider what’s included. Does your suite pay for WiFi and utilities? Does your salon owner charge commission? These are all things to be aware of. A salon suite gives you the ability to fully customize your workspace and make into what YOU want. That plus the ability to set your own schedule can be worth a premium.

"Working in a salon suite I feel has really opened up my business. I get to do so much more of it! I love that I get to do my own retail too and choose what I am selling." – Elise Sharp, Stylist at The Suites Spot

The remaining categories account for 1-3% each of your gross income:

- Liability Insurance (1%)

- Licenses & Permits (1%)

- Professional Savings (2%)

- Bank & Credit Card Processing Charges (2%)

- Software Booking System (2%) (Our stylists get a discount with GlossGenius!)

- Education (2%)

- Phone/Internet (2%) (Internet is provided free at The Suites Spot!)

- Client Amenities (1%)

- Marketing (3%)

Managing your finances is crucial to any successful business. Knowing what your expenses will be is a great first step for stylists just going independent, and a great reminder to any who already are independent and want to review their expenses!

Does your breakdown look similar to this or is it different? Let us know in the comments!

Ready to transition into a private salon suite? Contact us for availabilities!